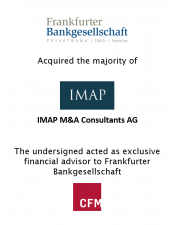

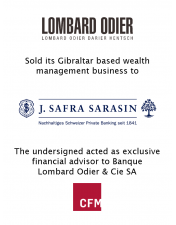

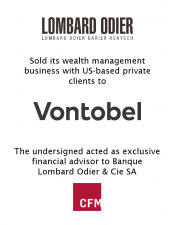

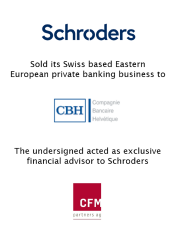

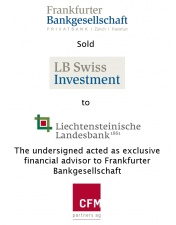

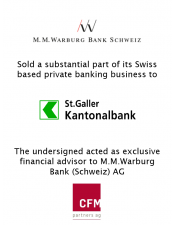

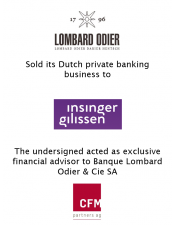

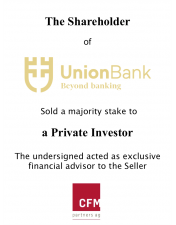

Public Transactions of CFM

Since its formation in 2012, CFM has successfully initiated and executed numerous transactions in the Swiss and international financial services space across a wide range of situations and sizes. The disclosed transactions include the following: